CHARITABLE STATUS |

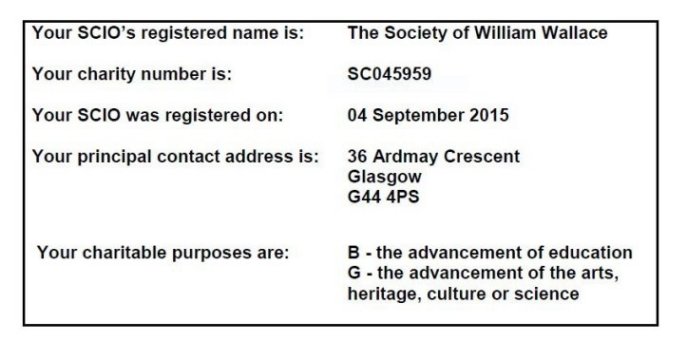

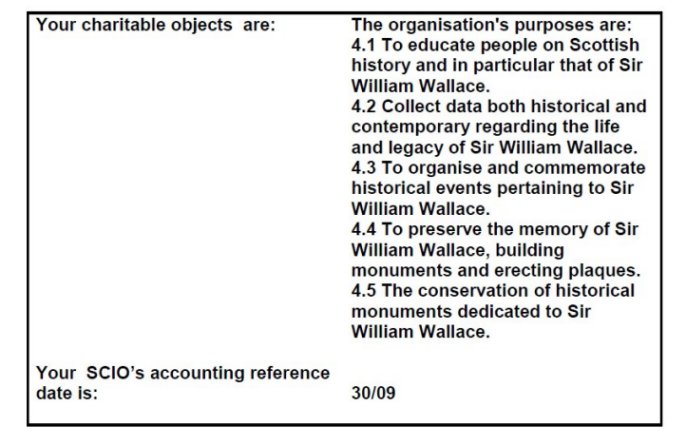

On the 4th September 2015, The Society of William Wallace was accorded Charitable Status. |

|

So what's this charitable status all about then? Why has the society all of a sudden after decades of existence decided that charitable status would be a good thing to have? Our Membership Secretary Stuart Duncan tells us why the society has gone down this path. When I joined the society I was surprised that society did not have charitable status. After all doesn't the society provide some public benefit in the work that it does through promoting Scottish history, traditions and the preservation of historic monuments? Do they not, in their own distinctive way, preserve and celebrate the distinctive character of Scottish society? All of the above are part of the Scottish Charity Regulators (OSCR) test for becoming a charity. So the society gets a pass mark on all counts. But what's the point, the society has survived decades without charitable status. That may be so but times have changed and many voluntary organisations now see charitable status as a prerequisite to their formation. So what are the advantages to achieving charitable status? Well, let's start with public recognition and trust. If you're looking for people either to join your organisation or donate money they have to be confident that their money will be used properly. The assets of a charity can never be used for private benefit. Did you know since gaining charitable status the society has tripled its membership? If you're asking an outside agency to fund a project then most funding organisations won't even talk to you if you're not a legal entity. That's no guarantee that you'll get the funding you're asking for but it at least it gets your foot in the front door. Then there is the financial benefit in tax relief you can obtain. Not that the society has massive reserves of money or an offshore bank account. No, it's having tax relief in the form of Gift Aid on donations that the society can receive from individuals, up to 20%. Exemption from Corporation Tax on any profits we make on trading. That reminds me - have you paid a visit to our online shop? And of course among others tax relief on funding. But with advantages there are always disadvantages. Charities may face some restrictions on what they are allowed to do. Political activities can be a bit of a minefield. Where you cannot be controlled or support a particular political party you can advocate a cause. Imagine the society of William Wallace being unable to support independence! With charitable status comes governance. Some may see that as a disadvantage as all of a sudden you have rules you have to follow, so less freedom. But this can also be an advantage as it gives the general public and society members the assurance that the society is being monitored and advised by the charity commission, run properly. By the way did I tell you that since becoming a charity we have increased our membership? I did? I wasn't sure. All in all the advantages outweigh the disadvantages - that's why just about every community group like ourselves join the thousands that go down that path towards becoming a recognised charity. Regards Stuart Duncan Membership Secretary 2015 |

|

The Scottish Charity Regulator granted the Society of William Wallace status as a Scottish Charitable Incorporated Organisation. We are obviously very proud of this fact, and will ensure that members do nothing to bring the Society into disrepute. This official recognition of the role of the Society will also aid us in our ongoing endeavours to uphold the eternal memory of Sir William Wallace. |

|

|

| © Society of William Wallace 2007-2026 | The Society of William Wallace is a Scottish Charitable Incorporated Organisation Registration number SC045959 |